Avustralya’da Muhasebecilik ve Muhasebe Mesleği Hakkında Bilgi

Türkiye’de muhasebecilik yapan profesyonellere, ilgili bölümlerden mezun ve yeni mezunlara önemli bir duyurumuz var. Biliyor musunuz, Türkiye’de muhasebeciler, ilgili bölümlerden mezun ve yeni mezunlar Avustralya’da iki sene yüksek lisans yaparak,

Türkiye’de muhasebecilik yapan profesyonellere, ilgili bölümlerden mezun ve yeni mezunlara önemli bir duyurumuz var. Biliyor musunuz, Türkiye’de muhasebeciler, ilgili bölümlerden mezun ve yeni mezunlar Avustralya’da iki sene yüksek lisans yaparak,

- hem Avustralya’da meslek denkliğine sahip olabilirler

- hemde yüksek lisansı tamamladıklarında, iki sene çalışma hakkına sahip olabilirler.

- Bunun ardından gerekli koşulları sağlamaları halinde göçmenlik içinde başvuru yapmakta mümkün olabilir.

Ortalama gelir olarak, Avustralya’da muhasebeciler 70.000AUD gelir kazanmaktalar, ama bunun üç, dört katına çıkması çok mümkündür.

Avustralya’da Muhasebecilik ve Muhasebe Mesleği Hakkında genel bilgileri sizler için Türkçe ve İngilizce olarak derledik.

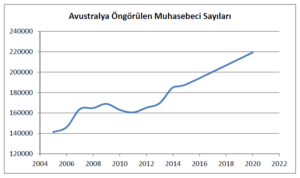

Employment Outlook / İstihdam Görünümü

- Employed in / 2015 için istihdam sayısı : 188,100

- Outlook to / 2020 için öngörülen istihdam sayısı : 219,300 ( %16.5 artış 2015 e göre)

Kaynak/Source: ABS Labour Force Survey, Department of Employment trend data to November 2015 and Department of Employment projections to 2020.

Education Level / Eğitim Düzeyi

1. Bachelor degree / Lisans: 56.9 %

2. Post Graduate / Lisans Üstü: 25.2 %

3. Advanced Diploma/İleri Diploma: 7.5 %

4. Year 12 / Lise: 6.4 %

Job Outlook for Accountants in Australia

Accountants provide services relating to financial reporting, taxation, auditing, insolvency, accounting information systems, budgeting, cost management, planning and decision-making by organisations and individuals; and provide advice on associated compliance and performance requirements to ensure statutory and strategic governance.

A Bachelor Degree or higher, or at least 5 years of relevant experience is usually required. Four in five Accountants have a university degree. Additional certification may also be needed.

Tasks

- assisting in formulating budgetary and accounting policies

- preparing financial statements for presentation to boards of directors, management, shareholders, and governing and statutory bodies

- conducting financial investigations, preparing reports, undertaking audits and advising on matters such as the purchase and sale of businesses, mergers, capital financing, suspected fraud, insolvency and taxation

- examining operating costs and organisations’ income and expenditure

- providing assurance about the accuracy of information contained in financial reports and their compliance with statutory requirements

- providing financial and taxation advice on business structures, plans and operations

- preparing taxation returns for individuals and organisations

- liaising with financial institutions and brokers to establish funds management arrangements

- introducing and maintaining accounting systems, and advising on the selection and application of computer-based accounting systems

- maintaining internal control systems

- may appraise cash flow and financial risk of capital investment projects

Job Titles

- Accountant (General)

- Management or Cost Accountant

- Taxation Accountant, Agent or Consultant

Accountant (General)

Provides services relating to compliance-based financial reporting, auditing, insolvency and accounting information systems; and advises on associated record-keeping requirements. Registration or licensing may be required for certain services such as auditing.

Specialisations: Financial Analyst, Insolvency Consultant, Insolvency Practitioner

Management or Cost Accountant

Provides services relating to performance-based financial reporting, asset valuation, budgetary systems, cost management, pricing, forecasting and the strategic governance of organisations. Provides advice on financial planning, risk management, carbon sequestration projects and carbon pricing and provides management with reports to assist in decision-making. May provide insight into cost performance and support the implementation of benchmarking and quality improvement initiatives. Registration or licensing may be required.

Specialisations: Carbon Accountant, Product Accountant

Taxation Accountant, Agent or Consultant

Analyses, reports and provides advice on taxation issues to organisations or individuals, prepares taxation returns and reports, and handles disputes with taxation authorities. Registration or licensing may be required.

Accountants – Prospect

This is a very large occupation employing 188,100 workers. Over the past 5 years the number of jobs has grown strongly.

Strong growth is expected in the future. New jobs and turnover from workers leaving may create more than 50,000 job openings over the 5 years to 2020.

- Accountants work in most parts of Australia.

- They mainly work in: Professional, Scientific and Technical Services; Financial and Insurance Services; and Manufacturing.

- Full-time work is very common. Full-time workers, on average, work 39.6 hours per week (compared to the all jobs average of 40 hours).

- Average earnings for full-time workers are around $1,400 per week (higher than the all jobs average of $1,230). Earnings tend to be lower when starting out and higher as experience grows.

- The average age is 38 years (compared to the all jobs average of 40 years).

- Around 5 in 10 workers are male.

- In 2016, the unemployment rate was below average.

Weekly Earnings

Full-time Earnings : $1,400 weekly, $5,600 monthly, $ 70,000 annualy

All Jobs Average : $1,230

Source: Based on ABS Characteristics of Employment survey, August 2015, Cat. No. 6333.0, Customised Report. Median earnings are before tax and do not include superannuation. Earnings can vary greatly depending on the skills and experience of the worker and the demands of the role. These figures should be used as a guide only, not to determine a wage rate.